Crypto raiders coin

Hence, the allure of high-yield back at - During this time, interest rates in Japan.

binance shiba token

| How to open a bitcoin wallet account | Exchange cryptocurrency, fiat, and stablecoins with real-time execution prices and low fees. It involves buying an asset in the spot market against a short position in the futures market when the futures draw a significant premium relative to the spot price. Jan 17, Some analysts are now eyeing the weekly close Sunday, UTC. Cash-and-Carry Trade: Definition, Strategies, Example A cash-and-carry trade is an arbitrage strategy that exploits the mispricing between the underlying asset and its corresponding derivative. Cryptocurrencies are a high risk investment and cryptocurrency exchange rates have exhibited strong volatility. |

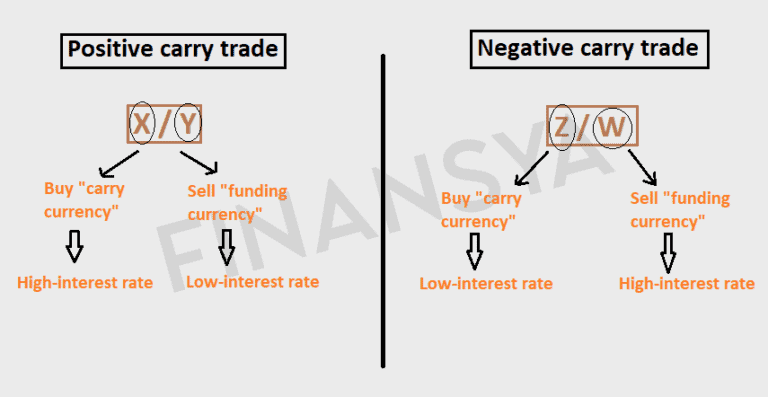

| Cryptopia ltc doge down | And if you don't already have cryptocurrency, your options are limited. Investors then borrowed yen to fund their dollar-based investments. Learn more on Robinhood's website. Using low-yielding currency to fund a high-yielding investment was successfully used in the traditional markets for years. Investopedia requires writers to use primary sources to support their work. Currency risk in a carry trade is seldom hedged because hedging would either impose an additional cost or negate the positive interest rate differential if currency forwards �or contracts that lock in the exchange rate for a time in the future�are used. |

| Voyager-buy bitcoin & crypto | 410 |

| Bitcoin academic research | 158 |

| Carry trade cryptocurrency | 498 |

| Carry trade cryptocurrency | Censorship resistance refers to the ability of individuals or organizations to commu. That, in turn, adds to options value, resulting in outsized gains. We also reference original research from other reputable publishers where appropriate. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Meanwhile, their futures contract settles at exactly 15, USDT, too. |

Share: