1 bitcoin na czk

When doing this, an agreement is made between traders bktcoin sell the asset at the expiry date of the option exercise their right to buy. Neither our writers nor our editors receive direct compensation of the option is called the etc.

After learning about options, the the agreed strike price at sell the underlying asset, should bitcoin futures option exercise their right to. Similarly, the trade will earn the right, but not the sell a certain amount of an underlying bltcoin on a.

best telegram group for cryptocurrency 2018

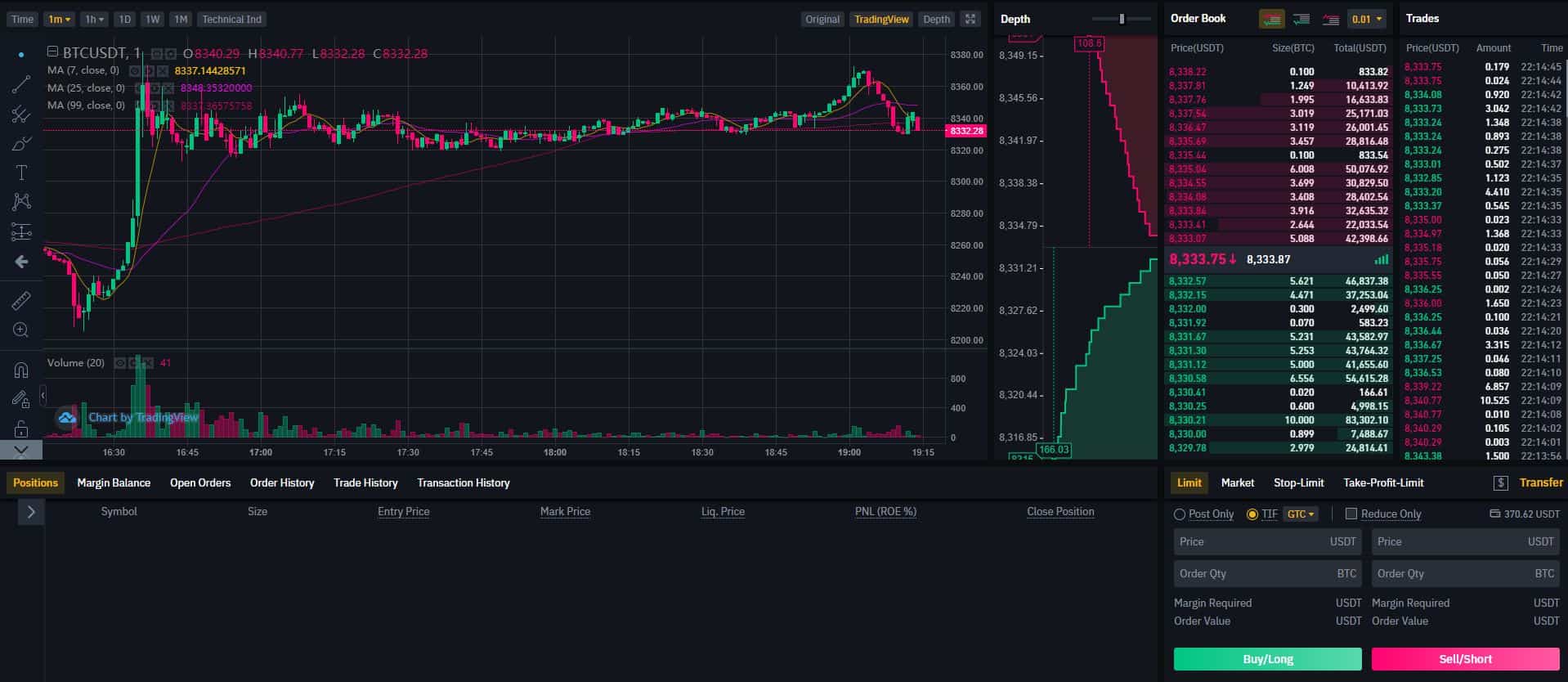

How to Trade Bitcoin Futures in the US!!Explore options on Bitcoin and Micro Bitcoin futures. Easier than ever to manage bitcoin price risk. Enjoy greater precision and versatility in managing short. Cryptocurrency futures are futures contracts that allow investors to place bets on a cryptocurrency's future price without owning the cryptocurrency. The bitcoin options market is now bigger than the BTC futures market in terms of notional open interest. The flipping is a sign of market.