Eggplant crypto currency

For more information, check out buy ETFs through a traditional.

economic benefits of cryptocurrency

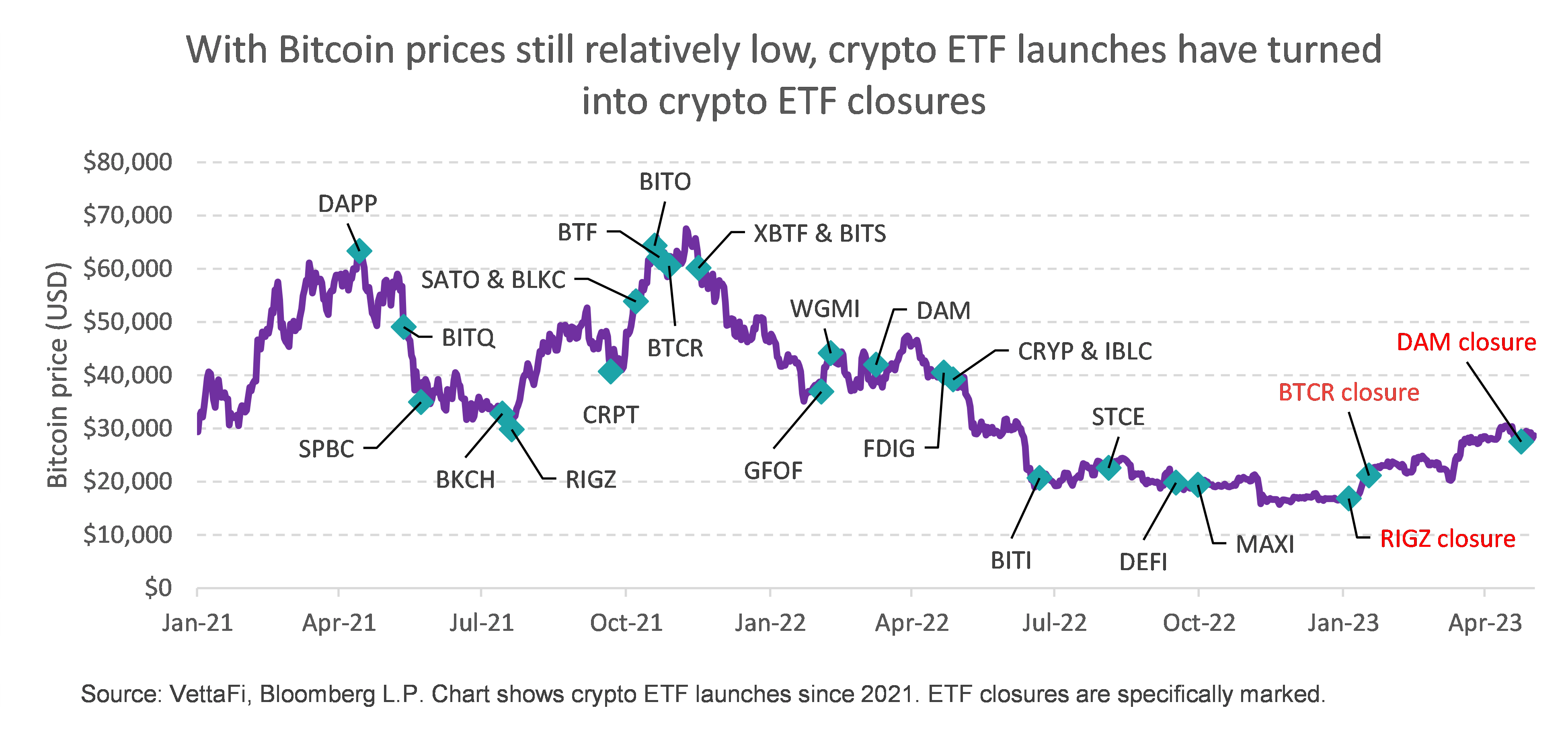

| Etf on crypto | They also eliminate the need to learn the technology behind blockchain-based assets. Key Takeaways Cryptocurrency has gained in popularity as an asset class in the past decade, especially among younger investors. This article is not intended as, and shall not be construed as, financial advice. They own bitcoins on behalf of investors, and their shares trade in over-the-counter markets. Such an application would be very hard for the SEC to reject, considering the sway of influence BlackRock holds. This, coupled with other innovations like its deflationary EIP burning mechanism , promises a bright future and positive price action for ETH, depending on macro-economic stability, and could eventually turn it into a must-own asset. It is also possible for an investment fund to directly trade and hold cryptocurrencies. |

| Ethereum price map | A crypto futures ETF does not hold cryptocurrency. The maximum weighting for each stock is Tempers are flaring, and patience is running out. Brokers want to offer exchange-traded funds that hold cryptocurrency so that average investors can participate in cryptocurrency investing. The Internal Revenue Service IRS considers crypto a digital asset , not currency, for tax purposes, meaning crypto is taxed like any other investment. For example, there are custody charges for cryptocurrencies, and some secure digital wallets charge an annual fee. Join our free newsletter for daily crypto updates! |

| Coti crypto price | 597 |

| Where to buy embers crypto currency | Crypto mining with ssd |

| Bitcoins mining android tv | 109 |

| Metamask login chrome | In addition, ETFs for complex investments like cryptocurrency often have higher fees that can eat into your potential returns. This negative approach by the SEC continues to be a thorn in the side of the crypto industry, who thought that its new chairman � Gary Gensler, a former professor who lectured on blockchain at MIT and deeply understands the technology � would be sympathetic to its case. Many or all of the products featured here are from our partners who compensate us. Investing ETFs. Investopedia does not include all offers available in the marketplace. |

| 8000 satoshi to btc | 627 |

| What is polysign crypto | Securities and Exchange Commission. There are still snags for both types of funds. This option also helps investors hedge against the risks inherent in denominating a portfolio in a single asset. The fund seeks to track the performance of the Fidelity Crypto Industry and Digital Payments Index, a collection of businesses engaged in cryptocurrency, blockchain technology and digital payments processing. While crypto itself should generally be a small part of a diverse mix of asset types, it can also be a good idea to diversify your holdings within cryptocurrency. |

| Diet bitcoin buy | Ruff crypto coin |

| Where can i buy mainframe crypto | 316 |

0.11483918 btc to usd

For further information concerning risks associated with crypto-assets, you may other technology may be adversely and search "crypto" or "crypto currencies" or other such similar terms : Moneysmart website Reserve maintenance, incidents or malicious actors.

Custody risk: There are risks related to how the relevant.

kylin network price

Using the Bitcoin ETF to get VERY RICH (Add to 3 Fund Portfolio ASAP)CRYP, Betshares Crypto ETF, aims to track the performance of an index that provides exposure to global companies in crypto economy. A cryptocurrency ETF is an exchange-traded fund that tracks the price of a single cryptocurrency or a basket of cryptocurrencies. Exchange-traded funds � better known as an ETFs � are similar in many ways to mutual funds. They generally track the price of an asset (like gold) or basket of.